Have global visibility of the entire Order to Cash process in each of your subsidiaries, as well as the KPIs that are critical for decision making.

Standardisation and control.

Easy adoption of corporate policies, enabling uniform management in all subsidiaries, monitoring and agile implementation of changes.

Standardised measurement of KPIs.

Standardised and comparable indicators that consolidate and process information from different information sources on a daily basis, providing unified reporting in all organisational units or subsidiaries of your organisation.

Treasury control and statement management.

Yndika facilitates compliance with IFRS 9. In addition, it records the entire history of OTC transactions carried out on its platform, with full traceability of status, users and actions performed.

Contribution to Corporate Governance

Standardisation

Integrate different organisational units or geographies of your organisation into a single platform, under a standardised system that facilitates the standardised implementation of corporate policies.

Control

After implementing a new transactions assessment or recovery policy in the subsidiaries, it is time to check how they are performing. Yndika allows you to easily and strategically view the actions carried out.

Immediate reporting

Consolidation

Companies grow and, with them, their complexity. Obtaining up-to-date information from each of your areas of responsibility is becoming increasingly complicated, with different sources and different ERPs, each with its own operation, language or currency. With Yndika, you can have all the information in a single environment.

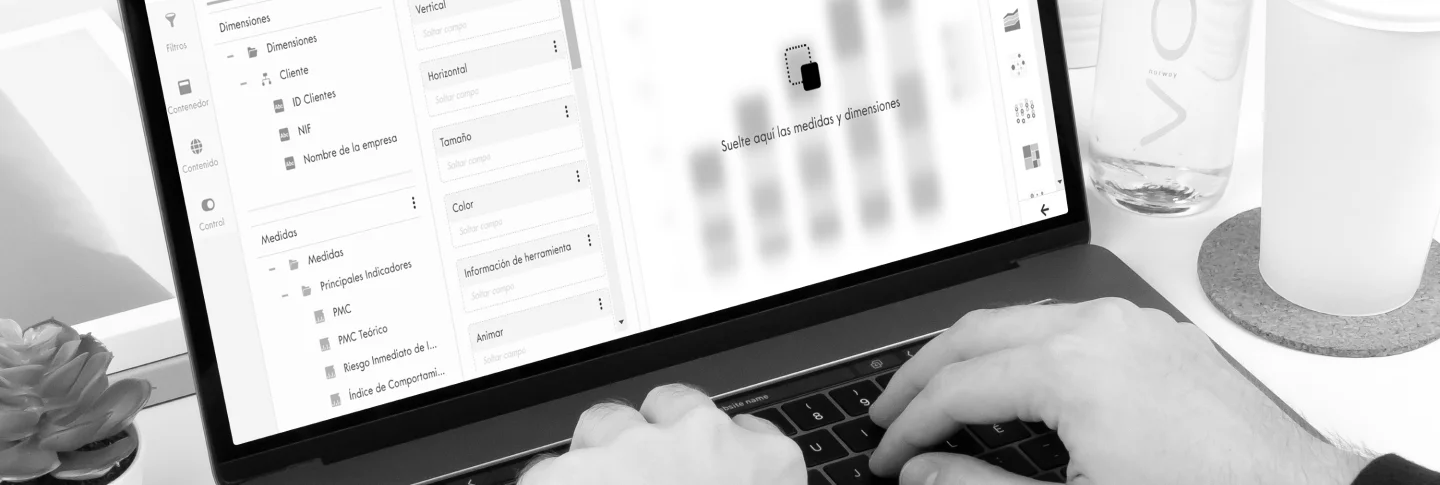

Customisation

Not all companies are measured by the same criteria. With Yndika, you will be able to design customised reports that really contribute to your business with all the potential of a Business Intelligence system.

In real time.

Obtain the main inputs of your business updated daily, with management and business reports and KPIs at corporate and subsidiary level.

Audit and traceability

IFRS9

Expected loss model for compliance with IFRS9 for the entire group.

Classification

Archiving of all transactions carried out with a digital file per debtor for their conservation and subsequent consultation and auditing.