We combine artificial and human intelligence to offer the best service. Our indicators achieve global predictive capacity values of up to 88% (AUC ROC), which translates into greater ability to identify delinquent debtors and sell more.

Our methodology is based on the following three pillars:

Machine Learning techniques in modeling.

We apply Gradient Boosting Machines and neural networks for pattern recognition, which are adjusted through self-learning, as opposed to traditional modeling approaches (logit). This allows for high prediction accuracy in samples with scarce or no available information (non-commercial or startup companies, self-employed individuals, and leads).

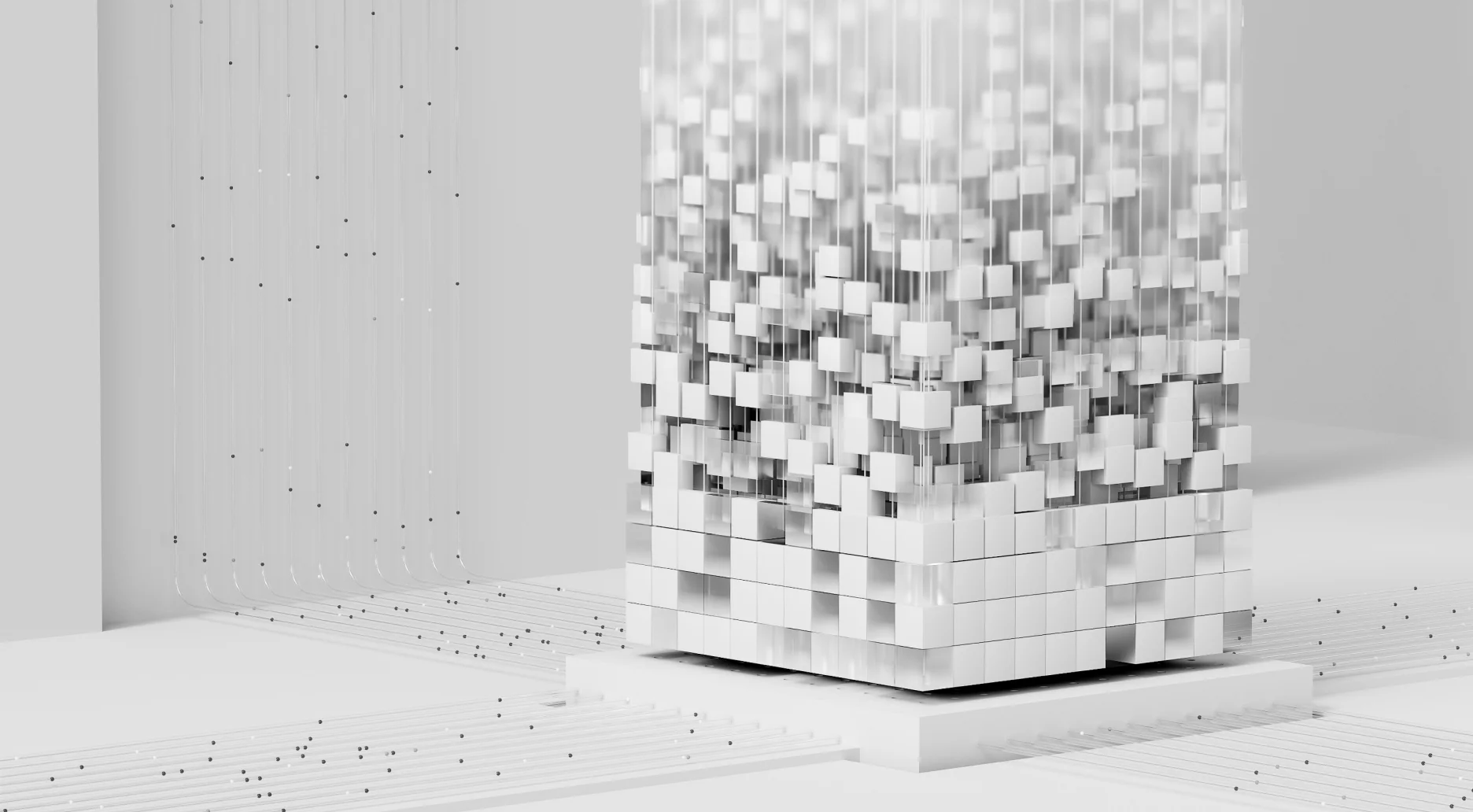

Atlax Data Cloud: the best big data for credit risk management

Atlax Data Cloud consolidates daily transactional information (Account Receivables) of each customer with information from public sources in each country (financial, commercial, judicial incidents, etc.), and the payment behaviour of their debtors and potential debtors with other suppliers, extending the customer's digital ecosystem in a secure and reliable way, and allowing the use of financial data in the natural progression of the business as a whole.

Altax Payment Behaviour

Our own calculation engine with great analytical capacity. Increased efficiency.

We process thousands of B2B transactions. Our advanced engine allows for the execution of all types of calculations and algorithms, both in real time and in batch executions. Its execution in the cloud guarantees security and availability.

Interview with the Atlax 360 engineering team. A data lake with AWS in the real world

What our customers say

A preventive approach in risk control

Atlax 360 provides greater security in commercial relationships, highly supported by commercial credit, allowing risk measurement before issuing an invoice and facilitating management for numerous corporations with large portfolios of debtors.

Control of 100% of the portfolio in real time

Gaining agility in response to changes in credit situations and flexibility in decision-making with clients or potential clients, reducing manual intervention.

Objectivity

Based on standard information, mitigating possible biases in the analyst's evaluation.

Comparability

Both over time and between debtors, as all ratings measure the same event and use the same risk scale.